Receive best direct trading signal in the markets. No matter where you are in the world.

The speed gap in existing technologies creates limitations for many market participants. We engineered Arbitrage Technologies® in Domain Specific Model (DSM) and Domain Specific Language (DSL), to bring all market participants with the same ultra high speed. Beside speed our systems are made for high volume trading, algotrading and ML & AI driven strategies.

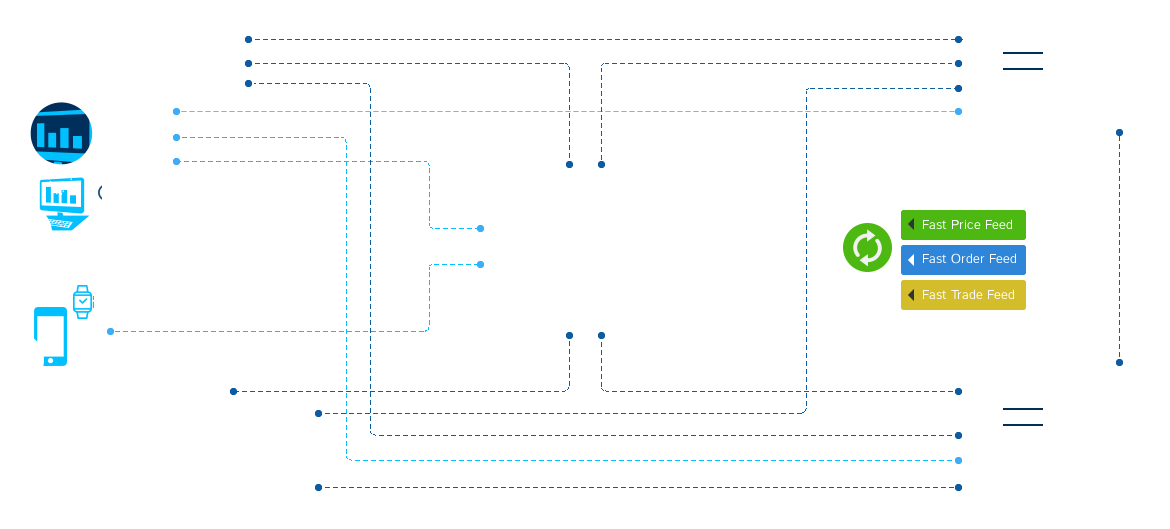

Arbitrage Technologies® brings trading consumer participants as close as possible to producers of securities found in Financial Exchanges. Bringing back margin in the market.

Our Information technology enables communication to optimize the process between the trading decision and the trading signal. Transparency allows Risk Management to control and authorize full compliance.

We design our system to let traders, risk managers and compliance officers to communicate efficiently in real time.

Eliminating barriers in order to maximize value creation. Capability to compete with the fastest. Our technologies provide the tools to gain easy access to native data.

Putting network in the spotlights. We embrace adoption of modern systems to leverage our technologies, rules and architecture to be in compliance.

We believe technologies should contribute to better financial markets. Bring transparency, independence, good governance and systems functioning at its best.

To facilitate the execution of strategies including Buy and Hold, access to data and latency are key elements. Arbitrage Technologies’ engineered software toolkits and access solutions are produced by ATs in-house designed innovative, certified and patented technologies.

Avoiding any technical delays or interruptions, designed to fit adequately institutional and traders’ core decision making algorithms, ATs software toolkits interpret native exchange data in truly real time (submicroseconds) giving a clear advantage to our customers.

Designed from scratch to fit customer needs of modern markets, the core systems model enables abstraction of complex objects and entities used by Financial Exchanges. Communication is streamlined and transparent. Working with this flexible framework permits us to build robust and unique customer solutions adapting easily to current and future exchange technologies.

Users of AT software toolkits and access solutions benefit from the unique language created to communicate seamlessly with Global Financial Exchanges. Complex objects and entities used by Financial Exchanges are decoded by AT’s software toolkits. Generating the dedicated code fitting the specific needs of each user in their preferred format; Python, Java, C++ and Swift.

The high performing software technologies and API's are now available to institutional traders, data analysts and individual tech savvy traders.

Arbitrage Technologies® embraces Software Defined Networking (SDN) and its approach to replace traditional network design as these networks do not support the dynamic scalable computing and storage needs of more modern computer environments such as datacenter.

We think networks are in the current available technologies undervalued and much progress can be made. The network is one of the major elements in connecting Financial Exchanges to allow people using their marketplace to trade with producers of securities. Arbitrage Technologies® facilitates the communications between the parties and make the markets work efficiently.

Bringing institutional and professional traders as close and as fast as possible to producers of securities found in Financial Exchanges to compete with the fastest market parties. Groundbreaking technologies are captured in easy to use customer focussed software toolkits and access solutions as not yet seen in the market place.